Hiring Employees in the Philippines: The Complete Guide

June 18, 2025 | Michael Warne

If you’re here, you’re likely weighing where and how to grow your team without compromising on quality or blowing up your budget. The Philippines has become a top choice for global hiring, and not just because of cost.

While its BPO sector put it on the map, today’s Filipino workforce is remote-ready, highly educated, and increasingly digital.

The country has built a deep bench of skilled professionals fluent in English, trained in global business standards, and experienced across industries like customer service, software development, finance, healthcare, and creative services.

But like any global expansion, it comes with its own regulatory and operational complexity.

This guide breaks down everything you need to know to hire in the Philippines efficiently and compliantly, whether you’re expanding for the first time or already managing global teams.

You’ll learn how to find talent, navigate local regulations, and leverage tools like Employer of Record (EOR) services to hit the ground running.

Now you can easily hire & employ international remote talent in full time jobs without opening international subsidiaries. Find out more about Tarmack's Employer of Record services.

Get StartedCan Foreign Employers Hire in the Philippines?

Foreign employers can indeed hire workers in the Philippines, but they must navigate specific legal requirements. Who can directly employ workers in the Philippines?

- Local companies registered with the appropriate government agencies

- Foreign entities with a legal business presence in the Philippines

For foreign companies to establish a legal presence, they typically need to register with:

- The Philippine Securities and Exchange Commission (SEC) for corporations

- Department of Trade and Industry (DTI) for sole proprietorships

- Bureau of Internal Revenue (BIR) to facilitate tax payments

The Philippines labor laws provide strong protections for workers. According to the Philippine Constitution and Labor Code (Presidential Decree No. 442), employers can only terminate employees for just or authorized causes with due process.

The Labor Code also prohibits discrimination against employees based on sex, race, or creed in terms of wages, work hours, and other terms of employment.

Links to third-party government sites are provided for convenience and informational purposes only. We do not endorse or guarantee the accuracy of information on external websites.

Options for Hiring in the Philippines

When hiring talent in the Philippines, you typically have two viable paths: set up a local entity or partner with an EOR. The right choice depends on your speed, scale, and appetite for admin complexity.

So, which path is right for you?

If you’re hiring 1–10 people, need to move fast, and don’t have a legal entity, use an EOR.

If you’re building a long-term regional hub with dozens or hundreds of hires, set up a legal entity.

Let’s look at the difference.

| Hiring Option | Legal Entity | Employer of Record |

|---|---|---|

| Best For | Long-term presence, 50+ employees, full control | Fast hiring (1–10 roles), no entity needed |

| Setup Time | 6–8 months | Days to weeks |

| Compliance Responsibility | Fully on you | Handled by EOR |

| Cost | High (setup + admin) | Moderate (EOR fees) |

| Control Over Employment | Full – you own contracts, processes, brand | Medium, you manage work, EOR manages the contract |

| Scalability | High – but slower ramp-up | Easy to scale initially |

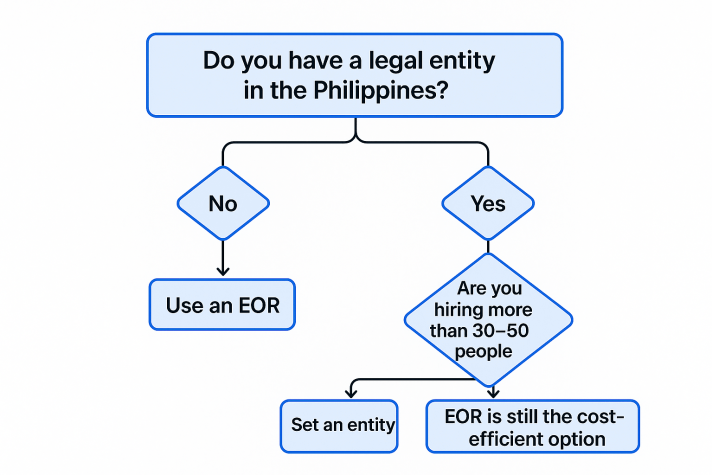

Our decision tree might make it easy to decide.

Employees vs. Contractors in the Philippines

Hiring freelancers gives you maximum flexibility and minimal overhead, but it comes with compliance risks. A digital agency, for example, might bring on Filipino designers for short-term projects without dealing with benefits or payroll taxes.

It’s fast and cost-effective, but misclassifying workers as contractors (when they function like employees) can lead to legal and financial penalties. Plus, contractors typically have less long-term commitment to your business.

| Feature | Employee | Contractor |

|---|---|---|

| Relationship | Direct employment relationship | Independent business relationship |

| Benefits | Mandatory benefits provided by the employer | Self-managed benefits |

| Taxes | Employer withholds and pays payroll taxes | The contractor is responsible for tax obligations |

| Control | High degree of control over work and schedule | Low control, focused on deliverables |

| Commitment | Long-term relationship | Short-term or project-based |

Best Practices to Hire Filipino Workers Directly

To hire Filipino employees directly, you’ll need to commit to a full legal setup, compliance, and integration. Done right, it allows you to build long-term, high-performing teams.

1. Register your business locally before you hire

To employ Filipino workers directly, you must register as a legal entity in the Philippines. For corporations, this means filing with the Securities and Exchange Commission (SEC); for sole proprietors, with the Department of Trade and Industry (DTI).

You’ll also need to register with the Bureau of Internal Revenue (BIR) and local agencies to handle taxes and statutory contributions. Without these, you can’t legally issue contracts, pay salaries, or operate within the Philippines labor laws.

2. Use the right sourcing channels

Local job boards like JobStreet and Kalibrr are widely used by Filipino professionals and tend to deliver strong applicant volume, especially for roles in customer service, tech, admin, and marketing.

Social media plays a major role, top Facebook groups and pages dedicated to job seekers are still heavily trafficked. If you’re hiring in specialized fields or at volume, local recruitment agencies can speed up the process.

3. Localize your contracts and policies

Employment contracts must align with Philippine labor laws, not just in content, but in structure and tone. Outline salary, working hours, probationary periods, benefits, termination terms, and payment cycles (typically bi-weekly or monthly).

Using foreign templates, especially those built around at-will employment can open you up to disputes or penalties. Clear, compliant contracts protect both you and your employees.

4. Onboard with structure and cultural awareness

First impressions carry weight. Before day one, make sure all tools, access, and systems are set up.

On their first day, greet new hires personally, explain expectations clearly, and walk them through performance metrics and team norms. Filipino employees value process, clarity, and inclusion.

5. Respect the Filipino workplace culture

Hierarchy, professionalism, and warmth all coexist in the Filipino workplace. Employees may be hesitant to raise concerns unless invited to speak, and they appreciate managers who offer clear guidance without harshness.

It’s common to use formal titles, and showing respect, through both tone and action, goes a long way.

Cost of Hiring Employees in the Philippines

Here’s what it costs to hire in the Philippines. If all the taxes and compliance seem overwhelming, take a look at how our finance teams can help you build a compliant global payroll.

| Cost Component | Typical Amount/Rate |

|---|---|

| Min. Daily Wage (NCR) | ₱533 – ₱610 |

| SSS (Employer Share) | Up to ₱1,900/month |

| PhilHealth (Employer Share) | 5% of salary |

| Pag-IBIG (Employer Share) | 2% of salary |

| 13th Month Pay | 1/12 of annual base salary |

Minimum wage and salary considerations

The minimum wage in the Philippines varies by region and industry:

- National Capital Region (NCR): ₱533.00 to ₱610.00 per day

- Regional variations exist based on the cost of living and economic conditions

Competitive salaries in the Philippines are generally lower than in developed countries due to the lower cost of living, making it an attractive option for employers looking to minimize labor expenses while maintaining quality standards.

Mandatory employer contributions

Employers in the Philippines must make these mandatory contributions:

- Social Security System (SSS): 9.5% of an employee’s monthly salary credit (capped at ₱1,900)

- Philippine Health Insurance (PhilHealth): 5% of the employee’s monthly salary

- Home Development Mutual Fund (Pag-IBIG): 2% of the employee’s monthly salary

Links to third-party government sites are provided for convenience and informational purposes only. We do not endorse the accuracy of information on external websites.

Additional employment costs

Beyond base salaries and mandatory contributions, employers must budget for:

- 13th Month Pay: Mandatory additional month’s salary paid annually (1/12 of annual basic salary)

- Holiday pay for regular holidays

- Overtime and night differential pay when applicable

- Severance pay for termination due to authorized causes

For example, if you employ an administrative assistant with a monthly salary of ₱25,000, you should budget for approximately ₱4,125 in monthly contributions (₱1,900 for SSS, ₱1,250 for PhilHealth, and ₱500 for Pag-IBIG), plus an additional ₱25,000 for their 13th-month pay spread across the year.

Want to see exactly how much you can save?

Use our Employer Cost Calculator to compare costs and discover the best payroll solution for your business. Click here to Calculate.

How to Pay Employees in the Philippines

Below is a simplified overview!

| Requirement | Summary |

|---|---|

| Salary Payment Method | Direct deposit to local bank accounts |

| Currency | Must be paid in PHP (Philippine Peso) |

| Tax Withholding | 0–35% based on income bracket |

| Work Permits | AEP, SWP, or PWP required for foreign workers |

| Visa Types | Commercial, Non-commercial, or 47(A)(2) |

The employment and tax regulations referenced in this article are based on publicly available information as of May 2025. Laws and policies may change, so please consult official government sources or legal professionals before making decisions based on this content.

If you’re hiring employees in the Philippines, handling payment correctly is non-negotiable. You’ll need to localize how you pay, stay on top of tax obligations, and ensure that foreign workers have proper documentation, all while staying compliant with Philippine law.

Start by choosing your payment method

Most businesses pay salaries via direct deposit into local bank accounts—this is the standard and preferred method. If you’re setting up a team, open a local business account with a bank like BDO or BPI to handle these transfers smoothly.

All payments must be made in Philippine Pesos (PHP), not USD or other currencies. If you’re converting from foreign currency, plan for exchange rate fluctuations in your payroll budgeting.

Handle your tax responsibilities

You are required to withhold income taxes from employee salaries based on the country’s progressive tax system (0–35%, depending on income level). Withheld amounts must be remitted to the Bureau of Internal Revenue (BIR) on time, along with regular filings.

Missed deadlines mean fines and interest charges. At year-end, you’ll also submit a full compensation summary using BIR Form 1701 to stay compliant.

Get the right permits

If you’re employing foreign workers in the Philippines, you’ll need to navigate visa and permit requirements early in the process. Most full-time foreign professionals will require a Pre-arranged Employee Visa (commercial or non-commercial, depending on the role).

For short-term consultants or specialists, a Special Work Permit (SWP) is faster and more flexible. A Provisional Work Permit (PWP) allows new hires to begin working legally while waiting for visa approval. Almost all foreign employees will also need an Alien Employment Permit (AEP) to confirm that no qualified local was available for the role.

In short:

- Use local bank transfers in PHP

- Withhold and remit taxes to the BIR

- Secure proper visas and permits for foreign hires

Read our article on how work visas differ from work permits.

Unions and Labor Organizations in the Philippines

The Philippines has several influential labor organizations that employers should understand when hiring locally:

- Trade Union Congress of the Philippines (TUCP) is the largest federation, representing workers across many sectors. A manufacturing company in Laguna worked with TUCP to develop competitive compensation packages that prevented labor disputes.

- Federation of Free Workers (FFW) takes a moderate approach, focusing on cooperative dialogue. A hotel chain in Cebu partnered with FFW to create fair work schedules that balanced business needs with employee well-being, improving retention.

- Kilusang Mayo Uno (KMU) advocates more actively for social justice and workers’ rights, particularly in manufacturing and export zones. A garment factory in Batangas maintained open communication with KMU to address concerns before they became formal disputes.

- Center of Trade Union and Labor Studies (SENTRO) focuses on education and policy development. A tech company in Manila used SENTRO’s training programs to help their HR team understand local labor dynamics.

- Public Services Labor Independent Confederation (PSLICK) represents public sector workers. While less relevant for most private employers, it’s important for companies that work with government agencies.

Understanding these organizations helps foreign employers navigate labor relations effectively when operating in the Philippines.

There’s a lot to unravel here, which is why the Philippines has made it to our list of top 20 countries you might need an EOR for.

Leveraging Global Solutions for Hiring in the Philippines

You can use specialized tools and services to improve your hiring processes in the Philippines by combining global practices with local expertise.

Benefits of using global employment platforms

Here’s how you’d benefit by using a global employment platform.

Easy compliance

Global platforms handle compliance across multiple jurisdictions. For example, a retail company expanding to Manila might use a platform that automatically creates contracts meeting Philippine requirements.

This approach could save dozens of hours previously spent researching Philipines labor laws, allowing the HR team to focus on finding qualified candidates.

Automated payroll and benefits

Automated systems ensure accurate payments. Consider a technology company with developers in Manila that implements a payroll solution to automatically calculate mandatory contributions like SSS (9.5%), PhilHealth (2%), and Pag-IBIG (2%).

This would eliminate manual calculation errors that often lead to compliance issues and employee dissatisfaction.

Reduced administrative work

Global employment platforms reduce paperwork and administrative tasks. In a typical scenario, a company might reduce time spent on compliance and payroll from 15 hours to 3 hours weekly after implementing such a platform. The HR team could then redirect this time toward more valuable activities like training programs and career development.

Scalable growth

These solutions support business expansion. A company starting with a small team in Manila could grow to dozens of employees across multiple Philippine cities using an Employer of Record service, avoiding the need to establish separate legal entities in each location.

Global Hiring Service Providers for Philippines

Several specialized services can support your hiring needs in the Philippines:

Employer of record services (EOR Philippines)

EOR Philippines handle legal employment, compliance, and payroll while you manage daily work. A company could use an EOR to hire staff in Manila without establishing a legal entity, potentially reducing hiring time from months to weeks.

Global payroll providers

These providers manage compensation across borders. They ensure employees receive accurate payments that comply with local tax requirements, which helps prevent issues with currency conversions and tax calculations.

Background screening services

Specialized screening services offer local verification. They help verify Filipino credentials and employment history more efficiently than attempting to do this from abroad, reducing verification time significantly.

HR compliance consultants

These consultants provide guidance on Philippine employment law. They can review draft employment contracts to identify potential compliance issues before they lead to legal problems.

Compliance Risks When Hiring in the Philippines

Here’s what to be wary of when hiring in the Philippines.

Incorrect payroll contributions

You don’t want to miscalculate mandatory contributions to payroll. If a company miscalculates SSS contributions and is later audited, they would face back payments, penalties, and damaged employee trust. The Philippine government regularly audits contributions to SSS, PhilHealth, and Pag-IBIG.

Unfamiliar employment laws

Local employment laws can create unexpected problems. For instance, probationary employment in the Philippines must be explicitly documented with clear performance standards. Without proper documentation, a company might inadvertently create a regular employment relationship, making termination more complex and costly.

Employee misclassification

Misclassifying employees as contractors creates liability. If a company sets fixed hours, provides equipment, and directly supervises workers but classifies them as contractors, it risks complaints that could result in claims for unpaid benefits and taxes.

Permanent establishment risk

Foreign companies may inadvertently create a tax presence. If a company allows representatives to negotiate and close deals in the Philippines without a legal entity, this might create a permanent establishment, triggering unexpected tax obligations.

Risk Mitigation Strategies

The following points can help you stay out of compliance trouble.

Partner with experts

Working with local experts or EOR Philippines services provides protection. This approach ensures compliance with local requirements while allowing you to focus on your core business operations.

Use reliable payroll systems

Specialized payroll systems reduce errors. Systems designed for the Philippine market automatically calculate contributions based on current rates and employee salaries, eliminating common manual errors.

Document relationships clearly

Clear documentation protects against misclassification claims. Detailed agreements for both employees and contractors should address control, equipment, work hours, and payment structure to properly establish the nature of the working relationship.

Structure operations properly

Proper business structuring helps manage tax risk. Companies should clarify which activities will be conducted in the Philippines and establish appropriate legal structures to maintain tax compliance based on their specific business model.

Did you know?

Tarmack helps you easily hire international talent as your full time employees without opening international subsidiaries. Find out more about our Employer of Record services

Learn MoreHire the Right Way With Tarmack

When you hire employees in the Philippines, you gain access to talented, English-proficient workers at competitive costs. While you must navigate complex labor laws and compliance requirements, the strategic benefits make this investment worthwhile for your organization.

Choose the hiring approach that fits your business needs. Establish a legal entity, partner with an EOR, or engage contractors. Each option offers distinct advantages. Understand the legal framework and cultural context to succeed in this dynamic market.

Explore Tarmack’s pricing plans. Get a Quote now!

Frequently Asked Questions (FAQs)

What is 13th-month pay, and is it required?

Yes, it’s mandatory. All employers must pay a 13th-month salary equivalent to one-twelfth of the employee’s annual base pay, typically issued in December.

Can I hire Filipino contractors instead of employees?

Yes, but only if the working relationship meets contractor standards. If you control their schedule, provide equipment, or treat them like staff, they may be misclassified, leading to fines and back payments.

How do I pay employees in the Philippines?

Use direct deposit to local bank accounts and pay in Philippine Pesos (PHP). You’re also responsible for income tax withholding (0–35%) and remitting payments to the BIR.

Can a foreign company hire workers in the Philippines?

Yes, but only under specific conditions. You must either set up a legal entity registered with the SEC, DTI, and BIR, or use an Employer of Record (EOR) to legally hire without creating a local company.

What is the minimum wage in the Philippines?

It depends on the region. In Metro Manila (NCR), the minimum wage ranges from ₱533 to ₱610 per day. Other regions may have lower or higher rates depending on local economic conditions.

A truly global HR platform with everything you need to build, grow & manage a global team.

- Identifying & recruiting the best talent

- Payroll with full compliance across 100+ countries

- Employment agreements as per local laws

- Contractor invoices & time management

- Smooth remote onboarding of employees

- Immigration & mobility services around the world